Tax deductions for self-employed individuals.Review the examples in the independent contractor deduction list below to see what types of tax benefits may apply to you. For example, a freelance web designer may not have any mileage expenses, but they could have home-office expenses to deduct. Independent contractor tax deductions – This will largely depend on what you do for a living.Estimated taxes include both income and self-employment taxes. As a self-employed person, you’ll pay estimated taxes as you go too – just on set dates four times a year. Here’s where you can find those estimated tax payment dates. Employers typically withhold taxes from employee paychecks each pay period, so taxes are paid as the year goes on. Quarterly estimated taxes – Again an employee-employer comparison is helpful here.To look at the numbers, read our post on self-employment tax (SE tax). You’ll actually get to deduct one half of the taxes which is equivalent to the employer portion when you file your tax return. Since you’re self-employed, you’re responsible for both halves.

In an employee-employer situation both parties pay a portion of these taxes. Self-employment tax – This is how you cover Social Security and Medicare taxes for yourself.Plus, you could also save yourself from a larger than expected tax bill. The more you can plan for these items, the easier it will be on you to file your tax return. Independent contractor taxes: Important conceptsĭon’t wait until tax time to find out about your tax responsibilities and considerations. You’ll thank yourself when it comes time to file. What if you work as an employee AND an independent contractor? These additional tax responsibilities will generally still apply, so don’t stop reading just yet.

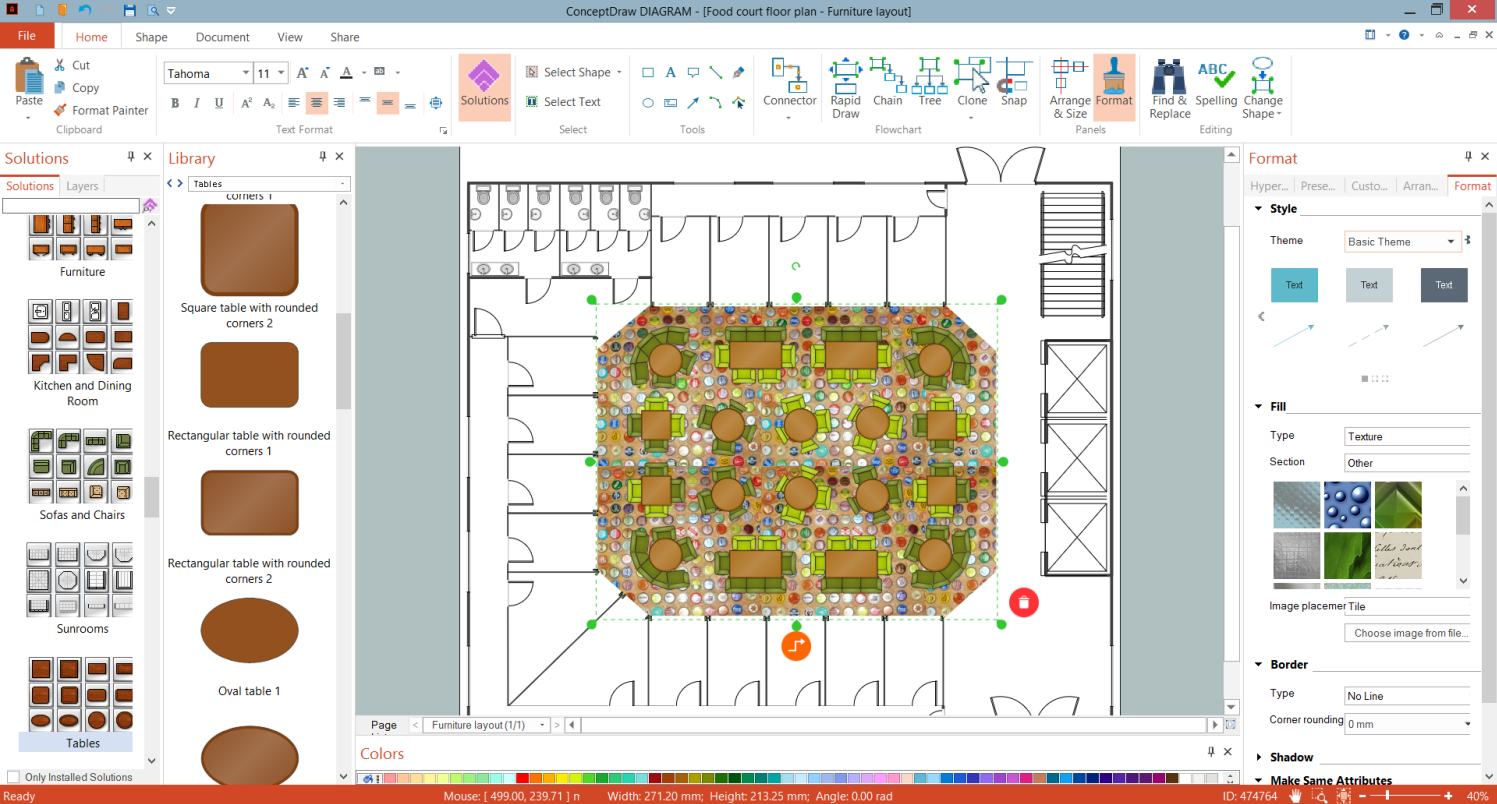

DIY LAYOUT CREATOR FAILED TO SET DATA FOR HOW TO

Consider these questions: Who has the right to control your behavior at work and the financial aspects of your job-or is that something the company decides for you? If you’re not sure, review our post on how to know if you’re an employee or independent contractor. How do you know if you’re an independent contractor and not an employee? It has to do with whether you or the business that pays you has more control over the details of your work. Working as an independent contractor after a job loss? Be sure to visit our Unemployment Resource Center for helpful articles and information. Plus, we’ll cover important elements of independent contractor taxes, such as self-employment tax, quarterly estimated tax payments, and independent contractor tax deductions. In this post, we’ll touch on the difference between independent contractors and employees. Wondering how you’re supposed to figure that all out? Rest easy we’ve got you covered. As an independent contractor, you’re required to pay your federal and state (if applicable) taxes to the Internal Revenue Service (IRS) and state revenue departments on your own, so they are not withheld from your paycheck. First things first – independent contractor taxes are different than when you’re a W-2 employee. With independent contractor work (sometimes called gig work or self-employment), our clients will ask “ why was no federal income tax taken out of my paycheck?”

0 kommentar(er)

0 kommentar(er)